Is VAT on medicines still in effect in Sri Lanka?

Opposition parties have accused the government of continuing to levy VAT on medicines in Sri Lanka. However, during parliamentary debates, the government categorically denied this claim, asserting that no such tax is being imposed.

by Anonymous |

February 27, 2025

In light of these allegations, FactSeeker conducted an investigation to verify whether VAT is being levied on pharmaceuticals in Sri Lanka, as misleading information has been circulated by members of Parliament during the ongoing budget debate.

During the second reading of the budget on the 25th (Thursday), Ranjith Madduma Bandara, Secretary of the Samagi Jana Balawegaya, questioned the accuracy of the claim that “VAT on medicines is still in effect in Sri Lanka.” He also alleged that, despite increased funding for the health sector, patients remain burdened with an 18% tax on medicines.

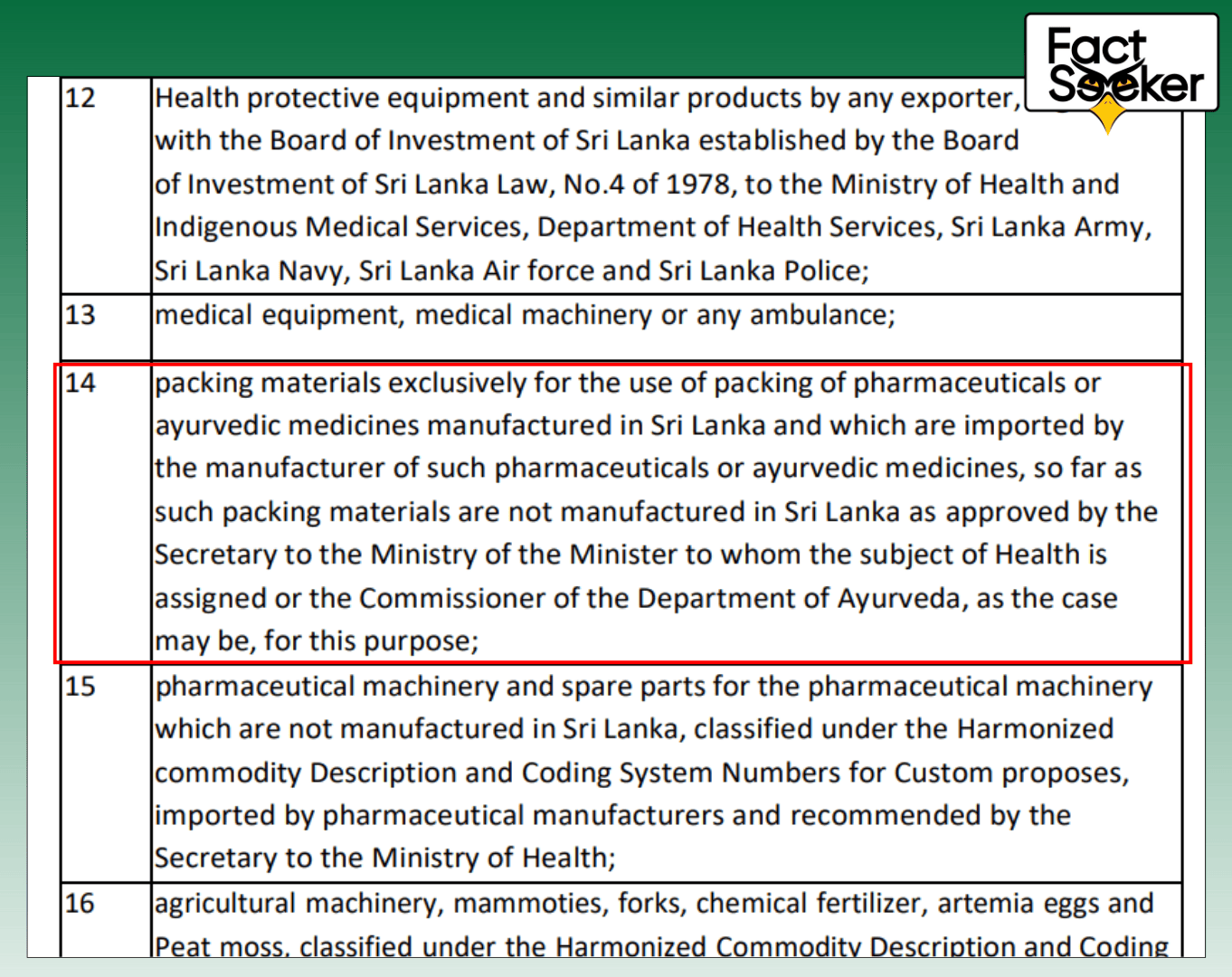

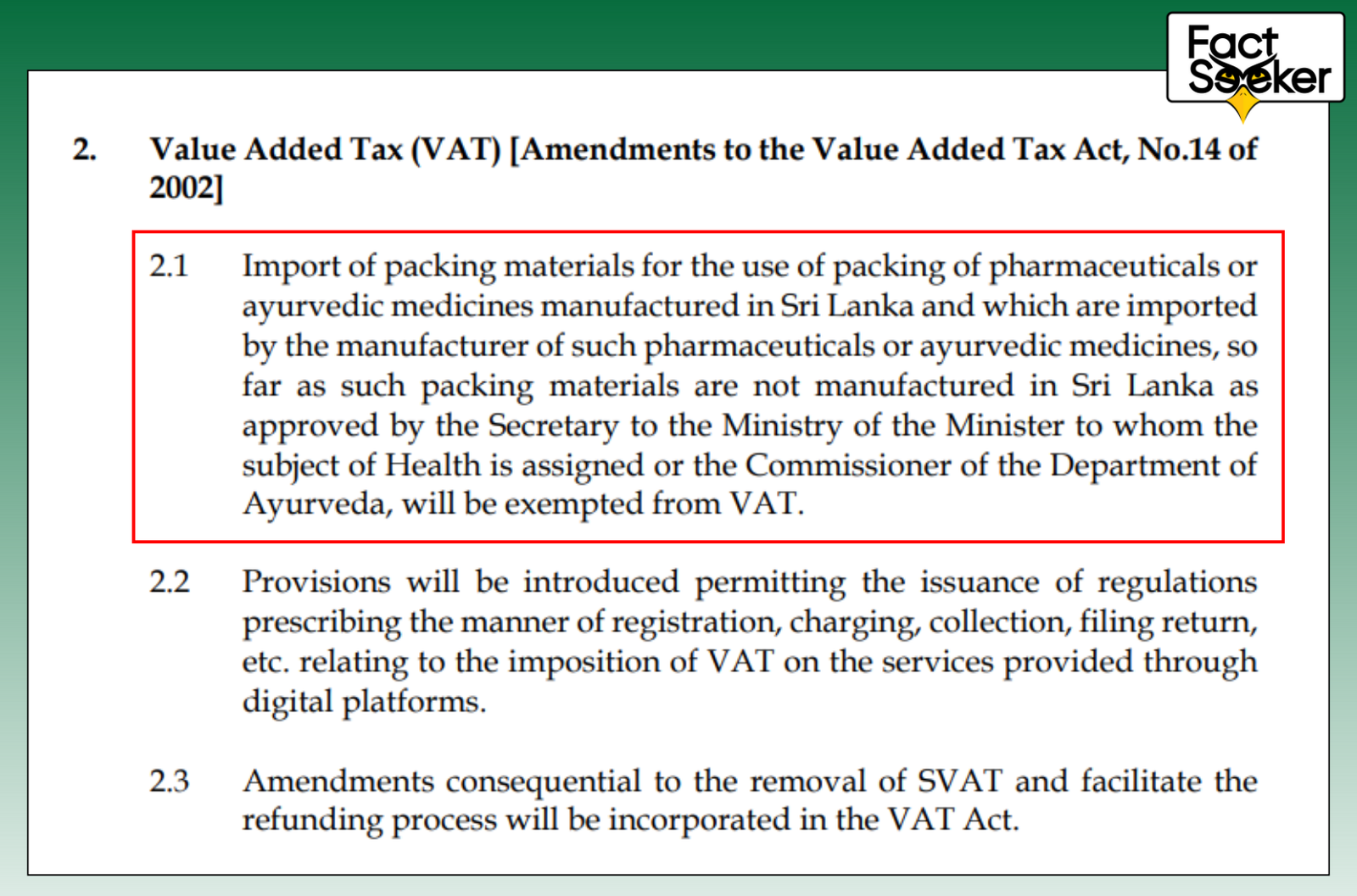

In response, Prime Minister Harini Amarasooriya denied the allegations, stating that VAT on pharmaceutical raw materials for domestically produced medicines has been removed.

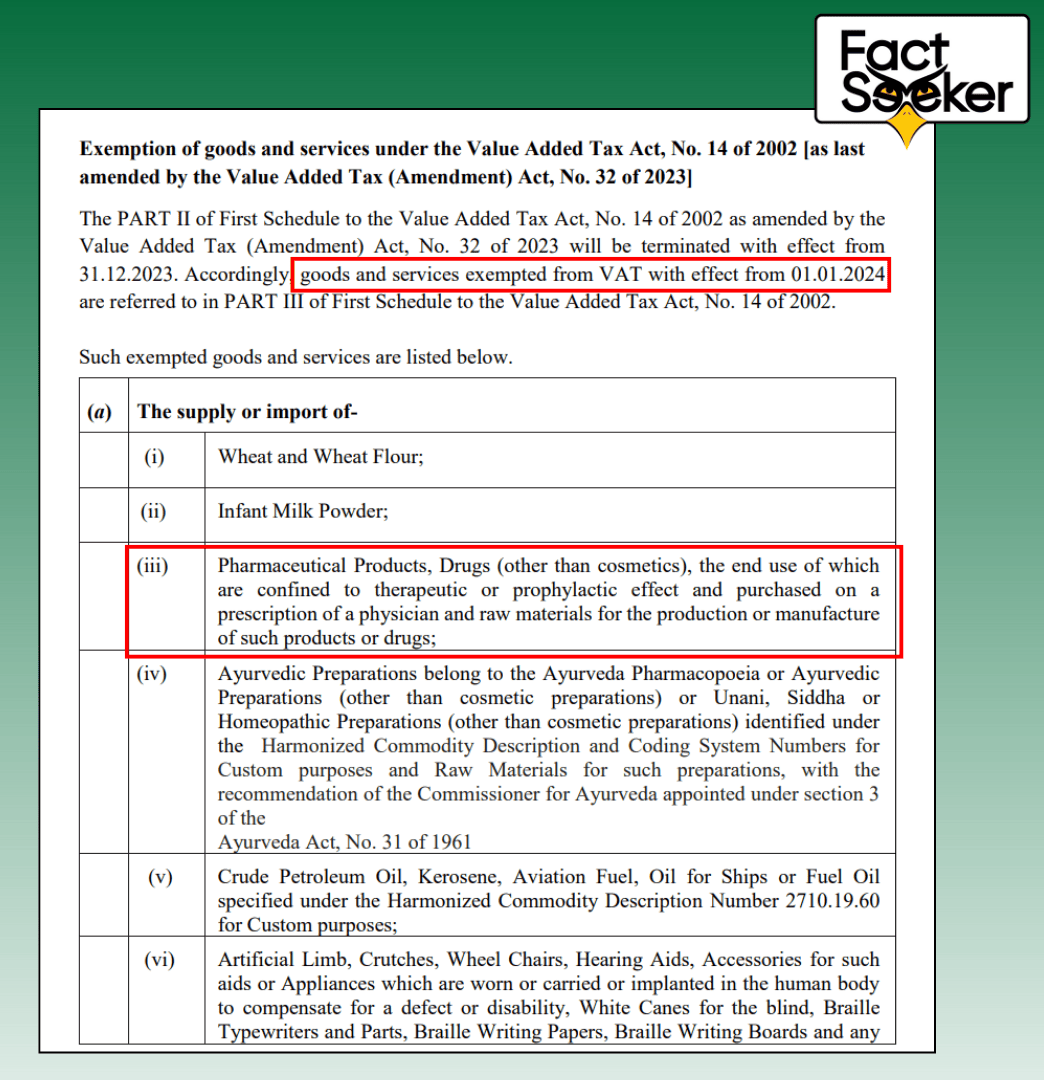

Upon reviewing the Value Added Tax (Amendment) Act, No. 32 of 2023, and the 2025 Budget Speeches, FactSeeker confirmed that medicines have been exempted from VAT, effective January 1, 2024. The exemption list clearly states that medicines, medical products, and raw materials are no longer subject to VAT.

Therefore, the 18% VAT on medicines was removed as of January 1, 2024, confirming that Member of Parliament Ranjith Madduma Bandara’s claim that “VAT on medicines is still in effect in Sri Lanka” is incorrect.

In conclusion, FactSeeker affirms that Prime Minister Harini Amarasooriya’s statements in Parliament regarding the removal of VAT on medicines are accurate, and that the claim made by Member of Parliament Ranjith Madduma Bandara is false.